Mexican Hat PEA

The Preliminary Economic Assessment referenced within is preliminary in nature. It includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

November 2020 | GMV Minerals is pleased to announce positive results from the Preliminary Economic Assessment (“PEA”) study of the Mexican Hat Gold Project, a low-capital, open-pit, heap-leach investment opportunity located in Cochise County, Southeastern Arizona.

PEA HIGHLIGHTS

FINANCIAL INDICATORS

The following table summarizes the financial indicators for the Mexican Hat project for both before and after taxes.

| Before Taxes | After Taxes | |||

| NPV cash flow @ 0% | US$220.4 M | NPV cash flow @ 0% | US$153.0 M | |

| NPV @ 5% | US$150.6 M | NPV @ 5% | US$100 M | |

| IRR % | 39.3% | IRR% | 29.3% | |

| Payback (years) | 2.85 | Payback (years) | 2.85 | |

Based on price sensitivity analysis at approximately the current price of $1,900 per ounce of gold, the project returns a pre-tax IRR of 58.3% (after tax 44.3%) and a pre-tax NPV at a 5% discount rate of $265.1 million (after tax $182 million) with a payback period of 2.10 years.

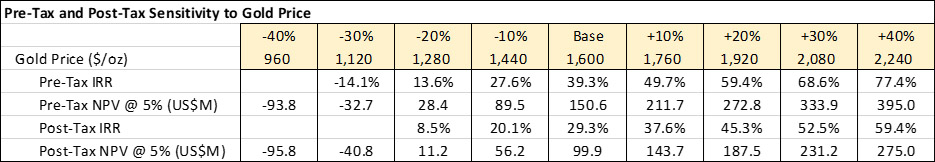

GOLD PRICE SENSITIVITY TABLE

The following table summarizes the pre-tax and post-tax economic results to gold price sensitivity.

INITIAL CAPITAL EXPENDITURES (US$ MILLIONS)

Initial capital expenditures are estimated at US$67.847 million as detailed below:

| Expenditure Cost Center | Totals US$ (Millions) |

| Contractor’s Mobilizations | $5,430 |

| Pre-Production Waste Removal | $4,300 |

| Process Plant & Infrastructure (Directs) | $28.597 |

| Process Plant & Infrastructure (Indirects) | $10.235 |

| Taxes | $0.950 |

| Owner’s Cost & Royalty Buy-Back | $6.067 |

| Contingency | $12.268 |

| Total | $67.847 |

OPERATING COSTS

The mine operating costs were calculated to average $2.68 per tonne mined as summarized below.

| Mine Operating Cost Center | Unit Cost (US$/t mined) |

| Owner Mining Personnel | $0.08 |

| Owner Supplies & Misc. | 0.03 |

| Contractor Mining | 2.56 |

| Total Cost (Rounded) | $2.68 |

The life-of-mine operating costs were calculated to average $15.30/tonne resource processed as summarized below.

| Operating Cost | Cost per Tonne of Crushed Material Processed |

| Mining | $7.69 |

| Processing | $6.81 |

| G&A | $0.80 |

| Total Site Operating Cost | $15.30 |

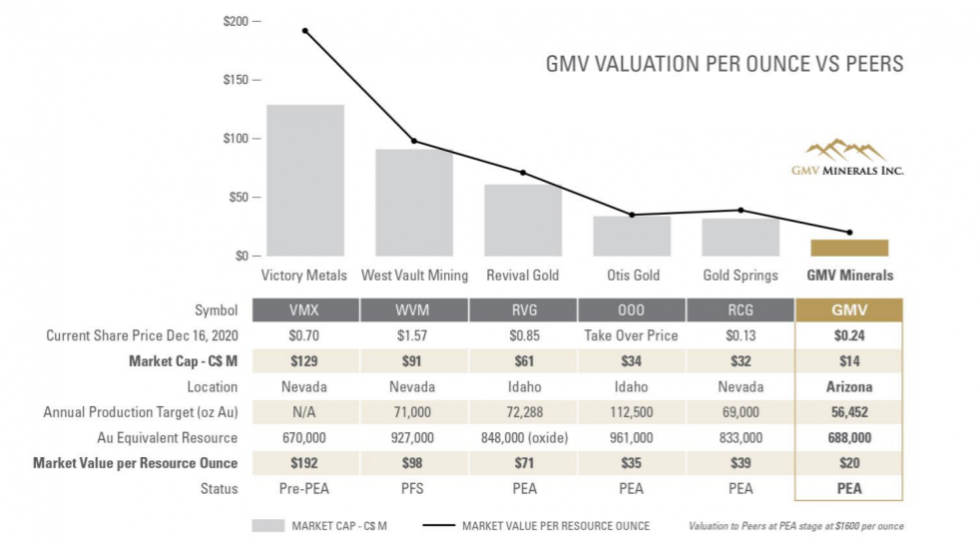

VALUATION CHART

TECHNICAL REPORT

A National Instrument 43-101 (NI 43-101) technical report entitled Updated Preliminary Economic Assessment, Mexican Hat Project” prepared by the following Qualified Persons will be filed by the Company within 45 days of this release on www.sedar.com:

Mr. Alva Kuestermeyer, Samuel Engineering, Inc. (Metallurgical Test Work and Recovery, Process Plant and Process Operating Costs)

Mr. Steven Pozder, P.E., Samuel Engineering, Inc. (Project Economics and Infrastructure)

Dr. Dave Webb, PhD., P.Eng., P.Geo., DRW Geological Consultants Ltd. (Property Description and Location, Accessibility, Climate, Local Resource, Infrastructure and Physiography, History, Geological Setting and Mineralization, Deposit Types, Exploration, Drilling, Sample Preparation, Analysis and Security, Data Verification).

Mr. James Barr, P.Geo., Tetra Tech, Inc. (Mineral Resource Estimate)

Mr. Thomas L. Dyer, P.E., Mine Development Associates a division of RESPEC (Mine Design, Production Schedule, Capital and Operating Costs)

Mr. Francisco Barrios, P.E., Tierra Group International, Ltd. (Pad Design and Loading)

Ms. Dawn Garcia, CPG, PG, Golder Associates Inc. (Environmental)

All Qualified Persons have contributed to their corresponding sections in Interpretation, and Recommendations. The Qualified Persons have reviewed and approved the scientific, technical, and economic information obtained in this news release.