Overview

Mexican Hat is a low sulphidation, epithermal gold deposit in Tertiary volcanic rocks. Similar deposits within the same basin and range province in Nevada, such as Round Mountain and the Midas Deposit, host many million ounces of gold. Since acquiring the property, GMV has increased its land position significantly to 4,800 acres. The property is now unfolding with multiple target zones.

Mexican Hat Highlights

(The Preliminary Economic Assessment referenced within is preliminary in nature. It includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.)

- Located in Cochise County, Arizona - 72 miles ESE of Tucson

- Mexican Hat claims and exploration licenses cover approximately 4,800 acres and form one of the most promising gold development opportunities in the western United States

- GMV has a 100% interest

- Extensive past exploration by Placer Dome (USA)

- Over 180 drill holes from past programs (approx. 22,000m)

- Preliminary metallurgical studies demonstrate recoveries ranging from 88.4% to 96%

- 2015 Column Leach Metallurgical results reconfirmed gold recoveries of 96.6% and 91.6%

Property Description

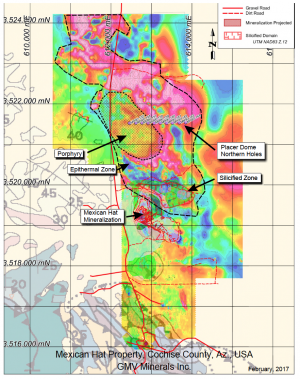

GMV Mineralization Map

The Mexican Hat is a unique feature located on the west side of the property that rises about 150m above ground level at an elevation of approximately 1,585m.

The property is a low sulphidation, epithermal gold system with good size potential, access and metallurgy. The property lies within the southeastern portion of the Basin and Range Province, a physiographic domain encompassing much of Nevada, southeast California, southern Arizona and part of New Mexico. Mineralization appears structurally controlled by fault-fracture (joint) zones and related breccias, commonly encountered in alkaline volcanic rocks. Gold has manifest itself in the free form within fractures that are typically intensely hematite altered. Hematized fractures have been found in all rock types found on the property. All units within the volcanic package may act as a possible gold mineral host.

No sulphides have been encountered on the property to date.

The geology and the stratigraphy of Mexican Hat consists of a Tertiary volcanic assemblage with main lithologies, occurring from oldest to youngest, that are described as a basal rhyolite breccia overlain by a trachy-basalt, a trachy-andesite, latite and an upper rhyolite tuff.

Resource

- The Mineral Resource Estimate has been constrained to a preliminary optimized pit shell, using the following parameters: SG = 2.57 gm/cc based on testwork, mining costs = $1.50/tonne, mining recovery = 98%, mining dilution = 2%, process cost = $3.25 per tonne, G&A = $0.55 per tonne, gold price = $1,375 per troy ounce, throughput at 15,000 tpd., discount rate = 5%. A cost of $0.03 was added per bench to the mining cost below the existing level surface.

- A top cut of 32 gpt gold is applied to all zones except Zone 6 which has a top cut of 50 gpt gold.

- Mineral Resources have been calculated using the Inverse Distance Squared method

- Mineral Resources constrained to optimized pit shells are not mineral reserves and do not have demonstrated economic viability.

- Conforms to NI 43-101, Companion Policy 43-101CP, and the CIM Definition Standards for Mineral Resources and Mineral Reserves. Inferred Resources have been estimated from geological evidence and limited sampling and must be treated with a lower level of confidence than Measured and Indicated Resources.

- All numbers are rounded. Overall numbers may not be exact due to rounding.

- There are no known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources

Grades, tonnes, grams and ounces are rounded and totals may not add up. A gold price of US$1,600 is assumed.

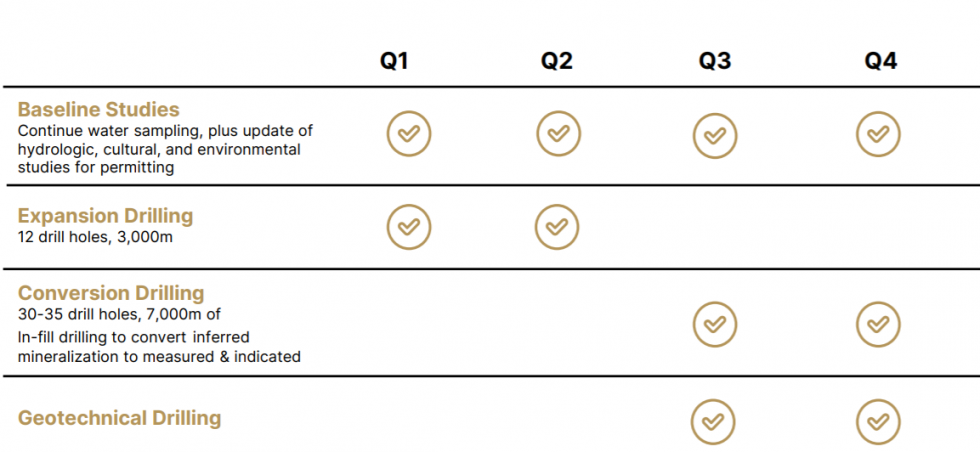

2021 Expansion Program

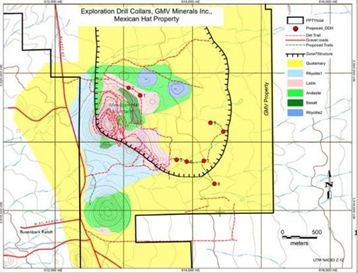

- Q1/Q2 2021 – 12 drill holes 3,000 metres includes North and Southeast drilling

- Significant exploration potential exists along strike and down dip on the principal controlling structure outside of the current resource area

- Specific portions of this arcuate fault that can be traced geophysically for close to 3 km beyond areas of known mineralization have additional indicators for mineralization such as proximal geochemical anomalies

- A proposed drill program has been designed to test eight separate portions of this target

Exploration Drill Collars, GMV Minerals Inc. Mexican Hat Property

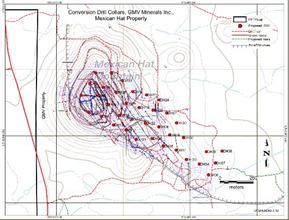

2021 Conversion Drill Program

A total of up to 38 diamond drill holes are designed to provide full coverage of the entire Mexican Hat deposit at 100 m +/ - centers. This will:

- Assist in the QA/QC of the historic drill results by twining or near twinning a large number of holes enabling conversion of some of the Inferred Resource into Indicated or Measured Resources

- Provide some geotechnical data and potential water flows to enable more specific engineered pit design

Conversion Drill Collars, GMV Minerals Inc. Mexican Hat Property

Mexican Hat Timeline

Net Smelter Royalty

The Mexican Hat Property is subject to a 3% net smelter returns royalty (NSR Royalty) in favour of Manual R. Hernandez, created pursuant to the terms of the Lease. The NSR Royalty is subject to a buyback right pursuant to which 1.5% of the NSR Royalty can be purchased by GMV in consideration of US$1,500,000. Pursuant to the terms of the Lease, the Company will be required to make advance royalty payments to Hernandez in the amount of US$4,500, payable quarterly. In addition, the Company will be required to undertake sufficient assessment work, make annual filings, and pay taxes, fees and rents as required to maintain the Mexican Hat Property in good standing